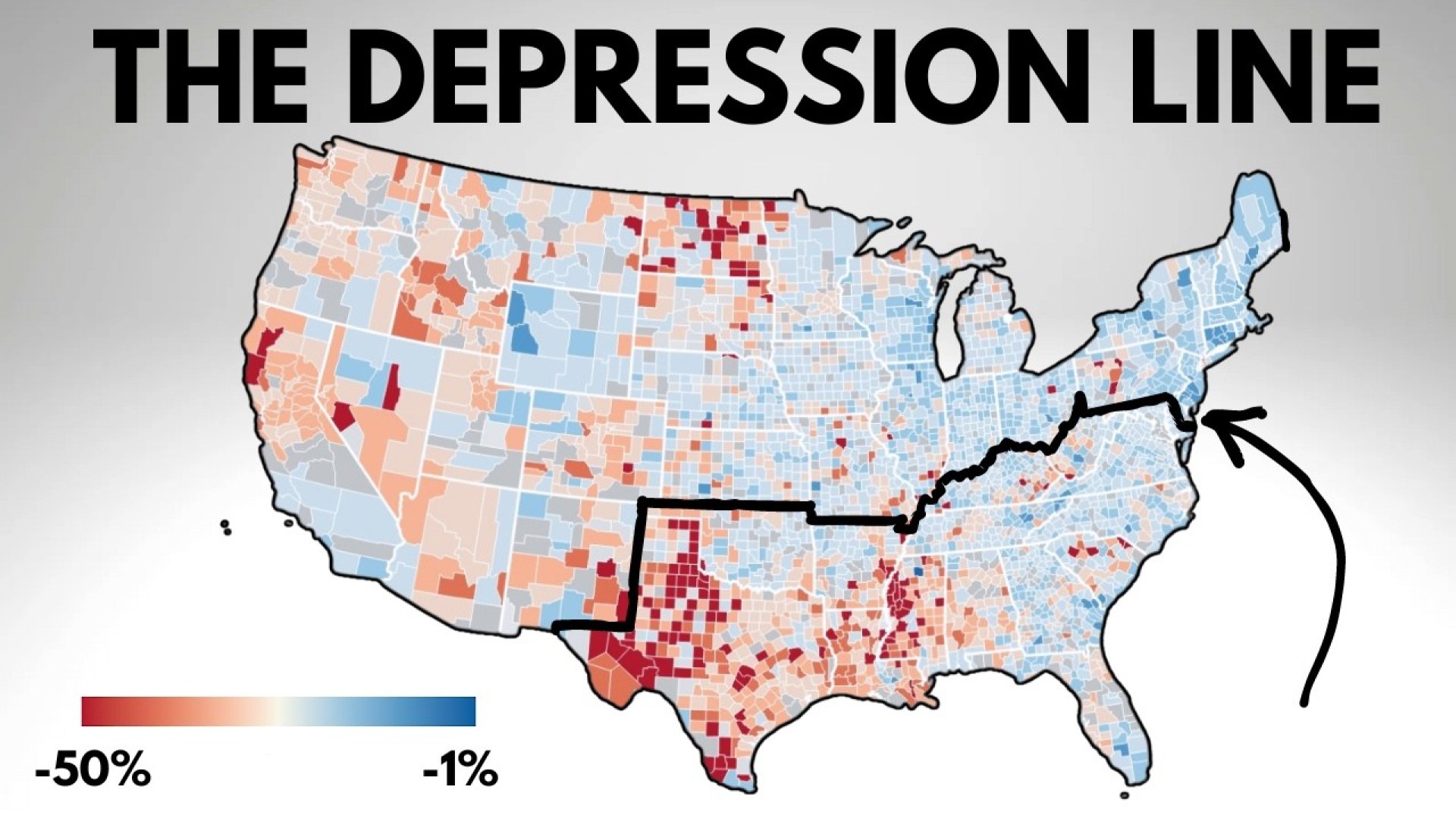

The Line That Explains The Coming Housing Depression

The Line That Explains The Coming Housing Depression

In this video, we explore the growing concerns about a potential real estate market crash, focusing on insights from renowned economist Robert Shiller. By analyzing the key factors that led to the 2008 financial crisis—rapidly increasing home prices, price-to-income ratios, and speculative buying—we draw parallels to today’s market,…

source

Click to rate this post!

[Total: 0 Average: 0]

Reviews

0 %

User Score

0 ratingsRate This

Sharing

45 Related Posts